How Long Will Retirement Funds Last?

Factors that Affect How Long Your Retirement Savings Will Last

Several factors influence the duration of retirement savings, all contributing to how long your nest egg will last. Factors such as the rate at which you withdraw your savings, the performance of your investments, and the impact of inflation play crucial roles in determining the longevity of your retirement savings. Understanding and considering these factors is essential in creating a sustainable retirement strategy that meets your needs and ensures long-term financial security.

Withdrawal Rate

The withdrawal rate is the percentage of your retirement savings that you withdraw annually to cover living expenses. This rate directly affects how long your retirement savings will last, as it determines the rate at which your nest egg is depleted. A higher withdrawal rate can provide a more comfortable lifestyle in the short term but increases the risk of running out of money in the long term. Conversely, a lower withdrawal rate can help ensure that your savings last longer but may require lifestyle adjustments to accommodate a lower income.

The 4% Rule

The 4% rule is a popular guideline for determining a sustainable withdrawal rate. Retirees can safely withdraw 4% of their initial retirement portfolio each year, adjusted for inflation, over a 30-year retirement period without depleting their savings. This rule is based on historical market data and assumes a diversified investment portfolio with a mix of stocks and bonds. While the 4% rule can be a useful starting point, it’s essential to remember that it’s only a guideline, and your circumstances may require a more conservative or aggressive approach based on factors such as investment returns, expenses, and life expectancy.

Investment Returns

The investment returns on your retirement savings significantly impact how long your nest egg will last. Strong returns can help your savings grow, while poor returns can deplete your funds more quickly.

Market fluctuations, inflation, and interest rates influence investment performance. To ensure your savings last, consider different investment scenarios, including best-case, worst-case, and most-likely outcomes. This helps prepare for market volatility and informs your investment strategy.

Inflation

Inflation can reduce the purchasing power of your retirement savings over time. When calculating your retirement income needs and expenses, account for inflation. You can do this by using an inflation-adjusted withdrawal rate or increasing costs by the expected inflation rate.

Longevity

Your life expectancy affects how long your retirement savings will last. Consider your individual health and family history to estimate your life expectancy. A longer life expectancy means your savings need to stretch further, while a shorter life expectancy may require less.

Calculating Retirement Savings Duration

Retirement is a significant milestone, but it requires careful planning. Calculating retirement savings duration is crucial, as it determines how long your savings will last. By understanding the factors that influence this duration, you can make informed decisions about your investments, expenses, and lifestyle to ensure a sustainable and enjoyable post-work life.

Simple Calculations

To estimate how long your retirement savings will last, follow these simple steps:

- Determine your total retirement savings, including all sources such as 401(k), IRA, and pension plans.

- Estimate your annual retirement expenses, considering factors like living costs, healthcare, and travel.

- Divide your total retirement savings by your yearly retirement expenses to determine the duration of your savings.

Example: If you have $500,000 in savings and expect to spend $40,000 per year in retirement, your savings will last approximately 12.5 years ($500,000 ÷ $40,000). This provides a rough estimate, and you may want to consider other factors, such as inflation and investment returns, for a more accurate picture.

More Complex Calculations

To get a more accurate estimate, consider the following factors:

- Total retirement savings: Include all sources, such as 401(k), IRA, and pension plans.

- Annual retirement expenses: Estimate essential and discretionary expenses, plus inflation (e.g., 3% annual increase).

- Sustainable withdrawal rate: Typically, it is 4%, but it may vary depending on investment returns, inflation, and life expectancy.

- Other sources of income Include Social Security benefits, pensions, and part-time work.

- Net annual expenses: Subtract other sources of income from total annual expenses.

- Retirement savings duration: Divide total retirement savings by net annual expenses and multiply by sustainable withdrawal rate.

Example:

- Total retirement savings: $750,000

- Annual retirement expenses: $50,000

- Net annual expenses: $30,000

- Retirement savings duration: 20 years ($750,000 ÷ $30,000) x 0.04

Strategies to Make Retirement Savings Last Longer

Retirement is a significant milestone in one’s life, and making sure your savings last throughout this period is crucial. With increasing life expectancy and rising healthcare costs, it’s essential to have a well-planned strategy to make your retirement savings last longer. Here are some effective strategies to help you achieve this goal:

1. Create a Sustainable Withdrawal Rate

Determine a sustainable withdrawal rate from your retirement savings to ensure you keep your funds manageable. As previously mentioned, a commonly recommended rate is 4% per annum, adjusted for inflation. This rate allows you to maintain your purchasing power while minimizing the risk of outliving your assets.

2. Diversify Your Income Streams

Having multiple income streams can reduce your reliance on a single source of income, making your retirement savings last longer. To generate regular income, consider investing in dividend-paying stocks, bonds, or real estate investment trusts (REITs).

3. Invest in Tax-Efficient Vehicles

Optimize your investment portfolio by allocating assets to tax-efficient strategies, such as Roth IRAs, tax-loss harvesting, or municipal bonds. This can minimize taxes and maximize your retirement income.

4. Prioritize Essential Expenses

Identify essential expenses, such as housing, food, and healthcare, and prioritize them in your retirement budget. This will help you allocate your resources effectively and make the most of your savings.

5. Review and Adjust Your Budget Regularly

Regularly review your retirement budget to ensure it’s aligned with your changing needs and expenses. Adjust your spending habits and investment strategy as needed to make the most of your savings.

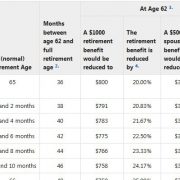

6. Maximize Social Security Benefits

Optimize your Social Security benefits by delaying claims or coordinating with your spouse. This can result in higher lifetime benefits and a more sustainable income stream.

7. Consider a Retirement Account Consolidation

Consolidate your retirement accounts, such as 401(k)s and IRAs, to simplify management, reduce fees, and improve investment returns. This can help your savings last longer and grow more efficiently.

8. Embrace a Flexible Retirement Lifestyle

Be open to adjusting your retirement lifestyle to make the most of your savings. Consider downsizing, relocating, or adopting a more frugal lifestyle to reduce expenses and stretch your retirement dollars.

9. Seek Professional Guidance

Consult with a financial advisor or planner to create a personalized retirement strategy tailored to your unique needs and goals. They can help you navigate the complexities of retirement planning and ensure your savings last as long as possible.

By implementing these strategies, you can increase the likelihood of making your retirement savings last longer and enjoying a more secure and fulfilling post-work life.

Bottom Line

The longevity of your retirement savings depends on a combination of factors, including your withdrawal rate, investment returns, inflation, and expenses. By adopting a sustainable withdrawal rate, diversifying your income streams, optimizing taxes, and prioritizing essential costs, you can increase the likelihood of making your retirement savings last. This is especially important if you’re considering early retirement, where you’ll need your savings to stretch even further.